Where town taxes go

When Town Administrator Derek Sullivan presented the Fiscal Year 2025 budget to the Select Board at its meeting on Tuesday, Feb. 20, he used a variety of charts and diagrams to make meaning out of the numbers.

Among them was a dollar bill, overlaid with varicolored rectangles to show what portion of town revenue goes to what expense.

A yellow rectangle, signifying school spending, took up almost half the dollar's face. After it in size were school and town employee benefits and public safety, each decreasing by roughly half.

"People always ask, 'Where do my dollars go?’ I think this is a fair representation," Sullivan said.

The numbers in the budget told a similar story — albeit with more detail and nuance.

Overall revenue into the town's coffers is projected at 3.27% higher in the Fiscal Year 2025 budget than in Fiscal Year 2024, at approximately $81.5 million in 2025 versus $79 million in 2024.

Some individual sources of that revenue increased, while others did not.

Estimated local receipts rose from $7.3 million to $8 million — that includes items like motor vehicle excise, local licenses and fees. Estimated new growth — the value of new properties constructed to the town — fell from $890,854 to $450,000; several large solar projects had come online and pushed the earlier year's new growth figures high, Sullivan said.

State aid for education, money from the state government to Wareham's school system, stayed essentially flat, with an 0.44% increase leaving it just under $17 million.

Even with school revenue not increasing, school expenses accounted for the largest increases in the Fiscal Year 2025 budget, Sullivan said. "Our biggest increases are education and then the employee benefits and then the state aid and the state assessments, which are also mostly the educational assessments.”

The School Committee has been working to balance its own budget and has shrunk its projected budget for Fiscal Year 2025 from its initial position, from a 10% increase over the previous year to a 6.73% increase, reducing the budget by around $1 million dollars.

Select Board members and Sullivan emphasized the town's support for education, even under the present financial constraints. Sullivan said with benefits included, almost two-thirds of the town's budget goes to education.

"There hasn't been a lack of town support for our education," said Select Board member Ron Besse. "We've been giving and giving and giving every single year, and it's increased, but you can't take money from where money isn't."

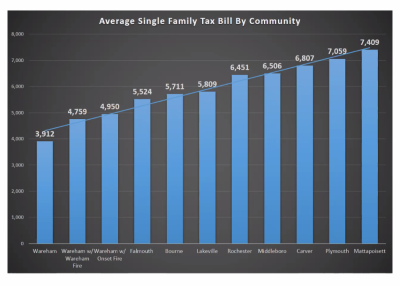

The Select Board and Sullivan also emphasized how Wareham's town taxes stack up against those of its peers.

Sullivan showed a chart comparing the average tax burden on a single-family home in Wareham with that on surrounding communities. The bill came out to $3,912 for a Wareham family, rising to $4,759 and $4,950, including Wareham Fire District or Onset Fire District taxes, respectively.

In neighboring Bourne, the same bill came out to $5,711, with the numbers rising higher for other surrounding communities. That's important, Sullivan said, because it translated directly into less money for the town: Wareham's tax revenue would be approximately $7 million dollars higher if it levied a similar tax bill as Bourne.